Come shape an industry with us

Explore Cardlytics careers to learn about the values that drive our success

We make marketing more relevant

Cardlytics is home to analysts and creatives, developers and data scientists, consultants and marketers, account managers, and artists. We believe in harnessing the power of purchase intelligence to increase sales, build brand awareness, and improve customer loyalty for businesses of all shapes and sizes.

We love our work. We love our team.

Follow Us

Help us build something great

Cardlytics values diversity, equity, and inclusion both within our company and in the world at large. Our ongoing commitment to fostering a diverse workforce and an inclusive, equitable culture is maintained through our collaborative space where everyone has a voice, feels valued, and is welcomed.

We celebrate and support what makes each of us unique and thrive on these differences for the benefit of our colleagues, our business, and our community.

We're proud of the robust variety in our team who are helping to grow our company to new heights, while ensuring Cardlytics is a great place where great people want to be.

Our Values

Growth over Comfort

Customer and Partner-First

Act with Urgency and Focus

Integrity with our Partners and Data

Accountability even when Challenged

Empowerment over Hierarchy

A Great Place to Be

Cardlytics is focused on building a revolutionary company, and we know this starts with investing in each of our employees. Caring about each other is a big part of what drives our exceptional desire to win and help our clients win.

Compensation Plus

Invest in your future with competitive pay, company equity, 401k matching, and bonus plans.

Health & Wellness

Full medical, dental, and vision coverage. Plus fitness classes, yoga, and wellness opportunities.

Level Up

Grow your career with Cardlytics University, onsite courses, and mentorship programs.

Work/Life Balance

Enjoy fluid work schedules and a flexible vacation practice.

Great Locations

Headquartered in Atlanta at Ponce City Market, with additional offices in London, New York, Oakland.

Make a Difference

Shape our community through special interest groups, including Diversity & Inclusion, Women of Cardlytics, and Philanthropy.

Compensation Plus

Invest in your future with competitive pay, company equity, 401k matching, and bonus plans.

Health & Wellness

Full medical, dental, and vision coverage. Plus fitness classes, yoga, and wellness opportunities.

Level Up

Grow your career with Cardlytics University, onsite courses, and mentorship programs.

Work/Life Balance

Enjoy fluid work schedules and a flexible vacation practice.

Great Locations

Headquartered in Atlanta at Ponce City Market, with additional offices in London, New York, Menlo Park and Champaign.

Make a Difference

Shape our community through special interest groups, including Diversity & Inclusion, Women of Cardlytics, and Philanthropy.

Atlanta

Ponce City Market

675 Ponce de Leon Ave NE

STE 4100

Atlanta, GA 30308

London

5th Floor

10 York Road

London

SE1 7ND

United Kingdom

New York

349 5th Ave, 7th Fl

New York, NY 10016

Menlo Park

333 Middlefield Road, STE 2000,

Menlo Park, CA 94025

Research & Insights

View all

The Controlled Consumer:

Why UK shoppers entered 2026 already spending with intent

The New Year value hunt started before Christmas.

Cardlytics’ State of Spend analysis of Q4 2025 and early Q1 2026 shows that UK consumers did not loosen their spending habits over the festive period. Instead, they became more deliberate about how and where they spent. Drawing on card-based transaction data from over 23 million bank accounts, the analysis points to a shift toward a more controlled approach to spending that is now shaping behaviour into 2026.

The last State of Spend showed that UK consumers had returned to the market, but with conditions. Spending resumed, but cautiously. Shoppers scrutinised price, convenience and perceived quality, pulling back when expectations were not met. Consumers would still spend, but largely when prompted by the right offer or moment.

The latest data shows that this scrutiny has since become embedded in shoppers’ habits. December revealed how consumers were already operating under tighter decision-making rules as they approached the new year.

With inflation ticking up again at the end of the year, cost pressures remained firmly in place. Rather than retreating from spending altogether, consumers adapted — switching formats, trading down and filtering purchases more aggressively. Festive spending held, but it was more controlled, with loyalty weakening and defaults increasingly questioned. As a result, consumers entered Q1 already spending more selectively.

Read the full report by downloading it here.

The Golden Quarter is Changing: Inside the 2025 State of Spend

The UK’s peak retail season is evolving. Consumers are still spending, but they’re more selective, strategic, and values-driven than ever before. Based on spend data from over 23 million UK bank accounts and nationally representative research, Cardlytics' State of Spend report uncovers what’s shaping the 2025 Golden Quarter — and where brands should focus to win.

Headline Trend Summaries (With Light Stats)

1. Black Friday is no longer the main event

The era of single-day shopping spikes is fading. Our data reveals that consumers are spreading spend across weekends and early December instead. Brands focused only on the Friday are missing the bigger picture.

2. Gifts that matter and don’t just impress

Over half of consumers say they’re choosing meaningful or practical gifts this year. Beauty and books are holding strong, while luxury and electrical categories are losing ground.

3. Fashion is fragmenting

Fast fashion still performs, but growth is slowing. Shoppers are shifting toward resale platforms and marketplaces that offer affordability and sustainability in one.

4. Grocery is about confidence, not just cost

Spend is still rising across grocery - but discounters, delivery services, and high-end grocers are outpacing traditional supermarkets. Value is no longer just about price; it’s about trust and convenience.

Consumers are still buying. They’re just doing it on their terms. The winners in 2025 will meet them where they are — with relevance, value, and visibility.”

Want the full data?

The full report includes:

- Category-by-category breakdowns from 2022 to 2024

- 2025 retail forecasts across 14 key sectors

- Consumer behaviour insights and shopping intent

- Strategic recommendations for campaign planning

Download the Full Report

UK Loyalty Movement Report: Retail

Introduction

In our previous report, Redefining Customer Loyalty, Cardlytics defined loyalty as a consumer’s preference for a merchant over its competitors, analysing spending across six industries to measure customer loyalty and spending patterns with both loyal and non-loyal customers.

But customer behavior isn’t fixed - customers shift between loyalty segments over time. Understanding these shifts helps identify churn and informs strategies to nurture relationships and move customers to higher loyalty segments. In our UK Loyalty Movement Report, we dive into customer behavior in the Retail category to better understand engagement over time by analyzing more than £245 billion in consumer spend behavior.*

Retail Category Loyal Customers

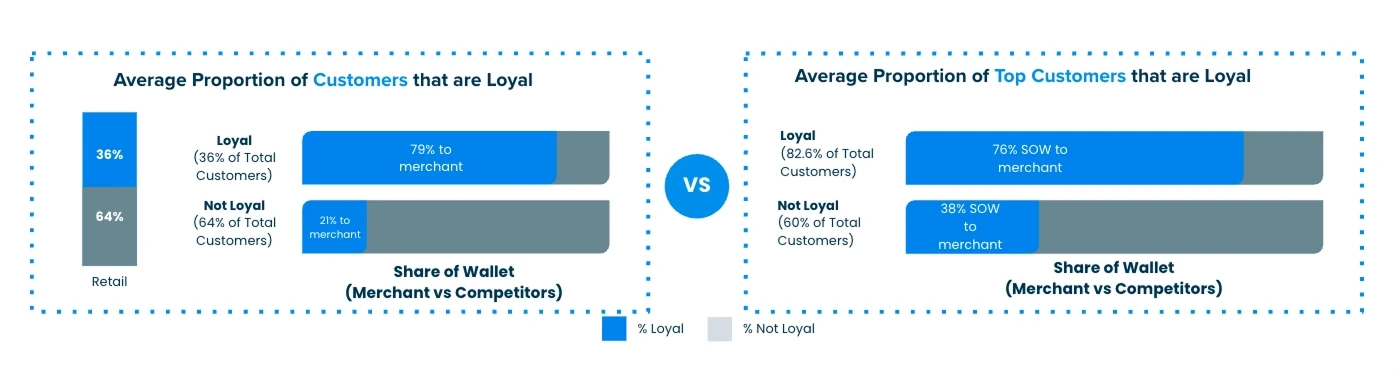

On average, 64% of a merchant’s customers are not actually loyal. But the loyal segment has a much higher share of wallet (79%) than a not loyal segment (21%).

Top Customers (top 20% of most frequent transactors) show a strong uptick as loyal vs not loyal customers. But the loyal customer segment shows more than 3x higher share of wallet.

Findings

We looked into purchase data across Retail in the UK over the last 8 quarters (Q1-23 through Q4-24) on a quarter by quarter basis to see whether even the “most loyal” customers showed changes in their purchase behavior.

Retail Loyalty Movement

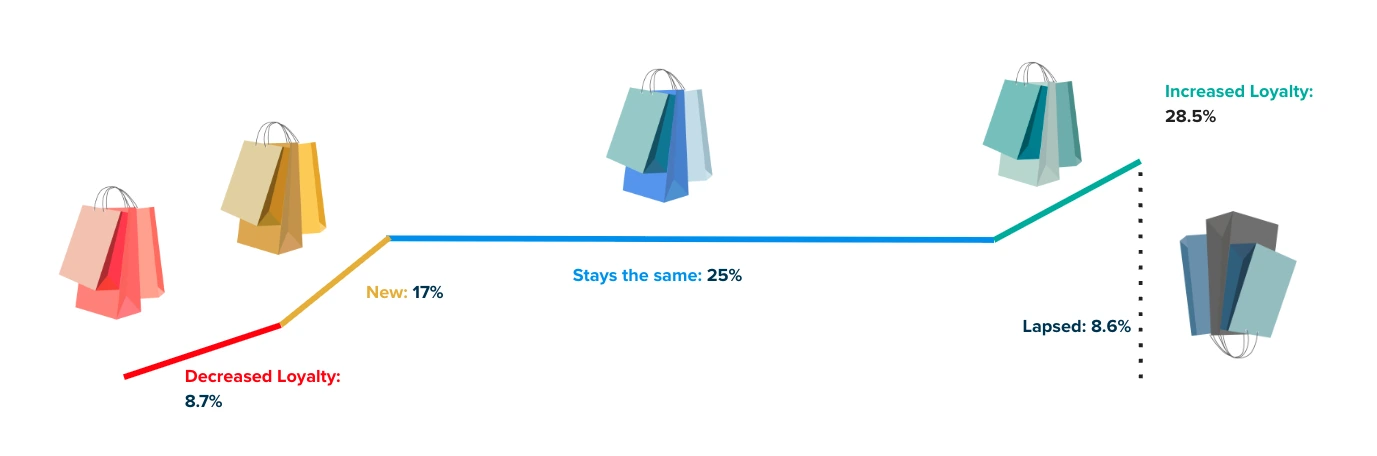

Overall, quarter over quarter, 25% of customers tend to remain in their existing segments while 37.2% increase or decrease their loyalty to a merchant. Yet there is much more extensive customer loyalty movement within the “not loyal” segments.

Segment movement

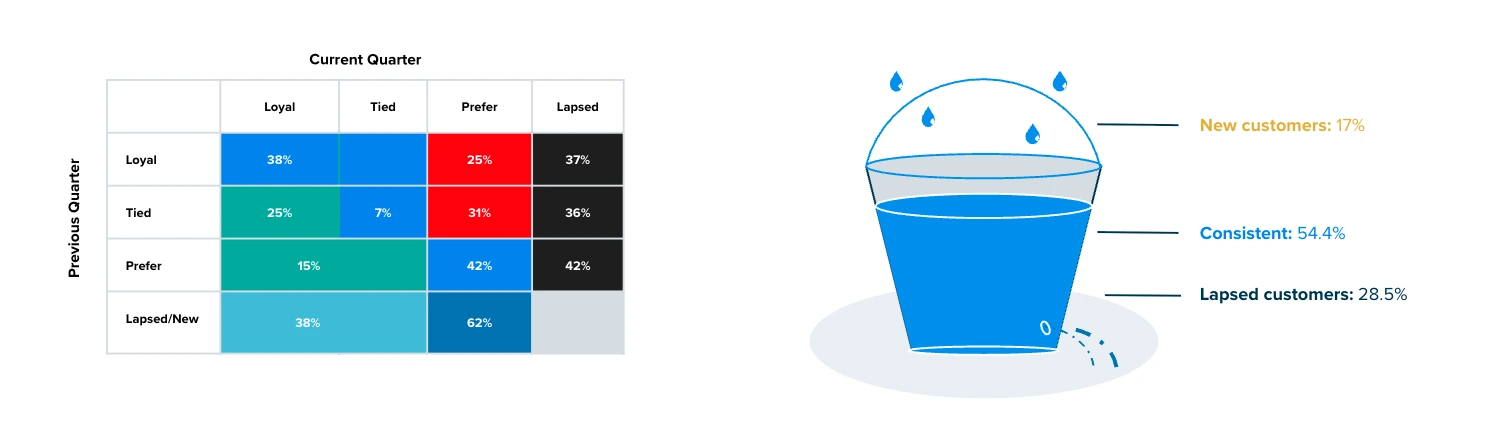

The Tied segment (part of the Not Loyal group) demonstrates the most volatility — with just 7% remaining stable and 29% moving up and 29% moving down into other segments.

Retail Leaky Bucket

Retail brands are acquiring new customers yet even more existing customers are moving into the lapsed tier. This cycle can be reversed by continuing to nurture existing customers.

Diving deeper into the individual segments tells us:

- Loyal customers and those that Prefer the competition are the most stable segments, with 38% and 42% respectively staying in the same category from one

quarter to the next. This indicates a strong commitment to brand preference — whether for your brand or a competitor's. - Customers in the Tied segment exhibit the highest level of movement, with just 7% remaining Tied quarter-over-quarter. These shoppers are the most susceptible to influence and represent a key opportunity for brands aiming to tip the scales in their favour.

- Interestingly, Loyal customers still show a 25% lapsed rate, which is comparable to the Tied segment’s 36% lapsed rate. This suggests that attrition among Loyal customers may not be driven by brand disengagement, but rather by natural gaps in purchase cycles — for example, customers who buy apparel less frequently.

Definitions of Customer Segments

Loyal Customers:

- Loyal: Only shop with a specific brand, or have the highest share of wallet with a given brand and relative rank is lower than all other brands in consideration set

Not Loyal Customers:

- Tied: Similar relative ranks to 2 or more brands regardless of share of wallet ranking

- Prefer: Lower share of wallet and higher rank than other brands in their consideration set

- Lapsed: Shopped historically but do not shop currently, as defined by the analysis time period

- New: Shop currently but have not shopped historically, as defined by the analysis time period

Takeaways

Marketers know it’s more costly to acquire or re-acquire customers than to keep existing ones engaged. When brands neglect current customers, they risk losing them and undoing past investment yet the reasons why a customer might “lapse” is different depending upon their loyalty tier. Loyalty is fragile and demands ongoing effort as competition is always close by. To stay top of mind, marketers must continuously nurture relationships, understand customer needs, and offer seamless experiences. To foster loyalty with your customers, consider these recommendations:

- Use an “always on” strategy to keep customers engaged, regardless of purchase

frequency. - Regularly update/refine customer segments and adjust reward offers to keep

them engaged. - Use targeted campaigns to boost loyalty and revenue.

Cardlytics can deliver a comprehensive Customer Loyalty Analysis with insights into customer behavior and movement across defined loyalty segments. Contact us for more details.